Index

- Income Tax Law Related Residential Status

- Amendment for Ay 2021

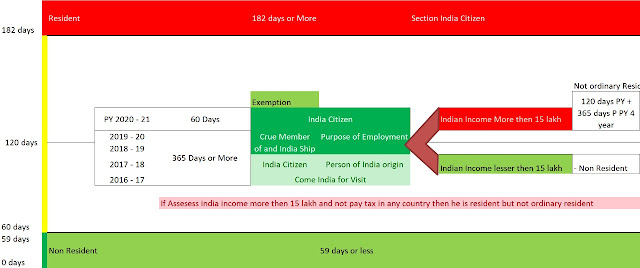

Residential Status

Question 1: When we are resident in India?

(i) He has been in India during the previous year for a total period of 182 days or more, or

(ii) He has been in India during the 4 years immediately preceding the previous year for a total period of 365 days or more and has been in India for at least 60 days in the relevant previous year.

|

Notes:

(a)

The term “stay in India” includes stay in the territorial waters of India (i.e. 12

nautical miles into the sea from the Indian coastline). Even the stay in a ship

or boat moored in the territorial waters of India would be sufficient to make the individual resident in India.

(b)

It is not necessary that the period of stay must be

continuous or active nor is

it essential that the stay should be at the usual place of

residence, business or employment of the individual.

(c)

For the purpose of counting

the number of days stayed

in India, both the date of departure as well as the date of

arrival are considered to be in India.

(d)

The residence of an individual for income-tax purpose has nothing to do with citizenship, place of birth

or domicile. An individual can, therefore, be resident in more countries than

one even though

he can have only one domicile.

|

Exceptions:

The following categories of individuals will be treated as resident in India only if the period of their stay during the relevant previous year amounts to 182 days or more. In other words, even if such persons were in India for 60 days or more (but less than 182 days) in the relevant previous year, they will not be treated as resident due to the reason that their stay in India was for 365 days or more during the 4 immediately preceding years.

(1) Indian citizen, who leaves India during the relevant previous year as a member of the crew of an Indian ship or for purposes of employment outside India, or

(2) Indian citizen or person of Indian origin1 who, being outside India comes on a visit to India during the relevant previous year.

Amendment

However, such person having total income, other than the income from foreign sources [i.e., income which accrues or arises outside India (except income from a business controlled from or profession set up in India) and which is not deemed to accrue or arise in India], exceeding ` 15 lakhs during the previous year will be treated as resident in India if -

- the period of his stay during the relevant previous year amounts to 182 days or more, or

- he has been in India during the 4 years immediately preceding the previous year for a total period of 365 days or more and has been in India for at least 120 days in the previous year.

Summary: Any one condition satisfied:

-- 182 days or More in PY

-- 60 or 120 days or more in PY (If Indian Earning More then 15 lakh in previous Year then 120 days for other case 60 days)

Preceding 4 year 365 days or more

Exemption:

Go outside Indian Citizen -- Member of Crew of Indian Ship or Purpose of Employment

Come Inside Indian Citizen or Person of Indian Origin being outside come for a visit in india.

Resident and ordinarily resident/Resident but not ordinarily resident

Only individuals and HUF can be “resident but not ordinarily resident” in India. All other classes of assessees can be either a resident or non-resident. A not-ordinarily resident person is one who satisfies any one of the conditions specified u/s 6(6).

(i) If such individual has been non-resident in India in any 9 out of the 10 previous years preceding the relevant previous year, or

(ii) If such individual has during the 7 previous years preceding the relevant previous year been in India for a period of 729 days or less, or

(iii) If such individual is an Indian citizen or person of Indian origin (who, being outside India, comes on a visit to India in any previous year) having total income, other than the income from foreign sources [i.e., income which accrues or arises outside India (other than income derived from a business controlled in or profession set up in India) and which is not deemed to accrue or arise in India], exceeding ` 15 lakhs during the previous year, who has been in India for 120 days or more but less than 182 days during that previous year, or

(iv) If such individual is an Indian citizen who is deemed to be resident in India under section 6(1A) [It may be noted that a deemed resident will always be a resident but not ordinarily resident].

Summary:

Resident and Not ordinary Resident if Satisfied any One Condition:

Non resident 9 out of 10 Preceding PY

Summary detail according to PY 2020 21 and AY 2021 22 .

Deemed Resident

(2) Deemed resident [Section 6(1A)]– An individual, being an Indian citizen, having total income, other than the income from foreign sources [i.e., income which accrues or arises outside India (except income from a business controlled from or profession set up in India) and which is not deemed to accrue or arise in India], exceeding ` 15 lakhs during the previous year would be deemed to be resident in India in that previous year, if he is not liable to pay tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

However, this provision will not apply in case of an individual who is a resident of India in the previous year as per section 6(1).